Have you ever stopped to think about the power a small amount of money can have over time? Most people underestimate the impact of compound interest on their financial lives. If you haven't heard of it yet, it's time to discover why this concept is so fundamental.

Imagine a grain of rice doubled every day for a month – at first it seems insignificant, but in the end, it turns into billions!

This is the multiplier effect that compound interest can have on your wealth. In this article, we'll explore why everyone should understand this incredible phenomenon and how it can change your financial trajectory.

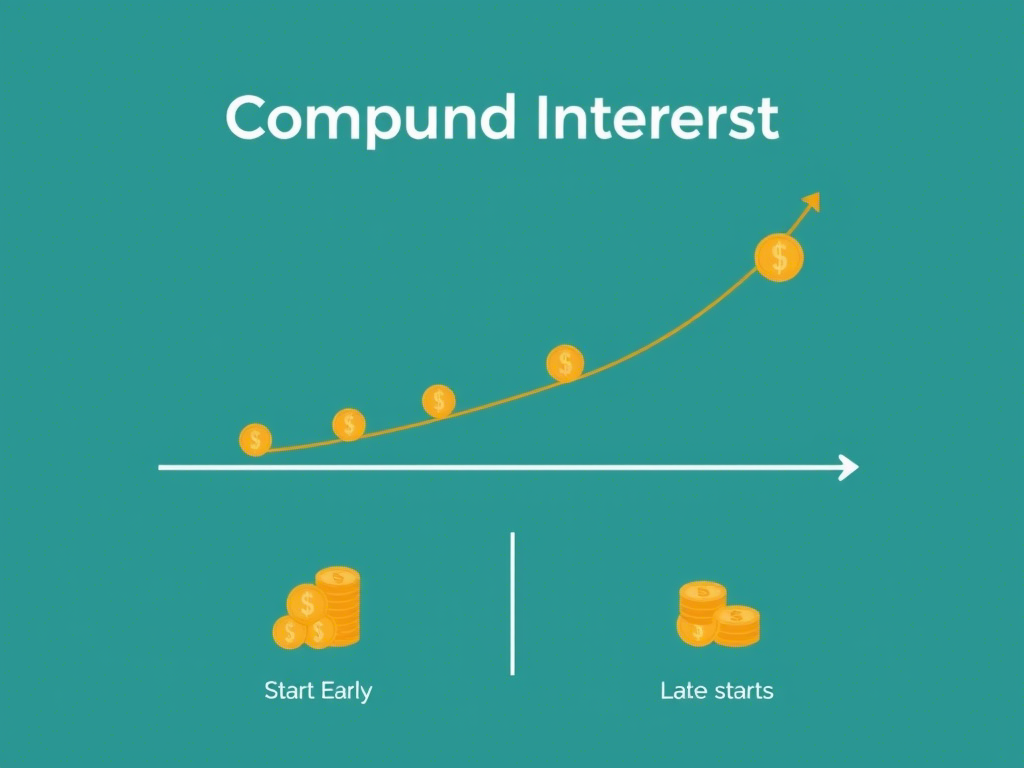

Compound interest is essentially "interest on interest." Unlike simple interest, where you earn only on the initial amount invested, compound interest causes your income to grow exponentially by periodically reinvesting your profits. It's like planting a seed that, in addition to growing, also automatically produces new seeds.

To illustrate, imagine you invest R$ 1,000 at an annual rate of R%. In the first year, you earn R$ 80. In the second year, however, the calculation takes into account both the initial capital and the R$ 80 already accumulated. Thus, the total amount increases continuously. Over decades, this difference can be astronomical!

This mechanic is especially relevant because we often begin our investments without realizing their true potential to generate wealth. Understanding compound interest is the first step to making smart financial decisions.

Now that we understand the concept, let's dive into real-world examples. Suppose John is 25 years old and decides to save R$500 per month in a fund that yields R$71 per year. After 40 years, when he turns 65, his balance will be close to R$1.5 million! This is because each monthly contribution has gradually grown based on compound interest.

Compare this to Maria, who started investing at age 35. Even if she invests the same monthly amount until age 65, she'll accumulate about R$750,000—less than half of what João achieved. This difference occurs because Maria missed out on a crucial decade of exponential growth.

This story clearly demonstrates how starting early can make all the difference. No matter how small your initial investment is, the important thing is to start now. Every day delayed means less time for your money to work for you.

Unfortunately, despite being a simple concept, many people ignore compound interest for two main reasons: lack of financial literacy and impatience. Many people expect quick results and end up neglecting the power of slow, steady growth.

Imagine someone who buys a new car every year, spending R$50,000 instead of investing that money. In 20 years, those expenses could add up to millions if spent correctly. But in the short term, buying something now seems more rewarding.

Furthermore, some people think that saving small amounts isn't worth it. However, even R$100 a month can add up to large sums over time. Therefore, don't underestimate the power of small, continuous efforts.

If you want to make the most of the benefits of compound interest, here are some practical tips:

Start today : The sooner you start, the better. Even small amounts will make a big difference over time.

Choose good investment vehicles : Look for options that offer consistent and secure rates of return, such as Treasury Direct, index funds, or stocks.

Always reinvest : Make sure to reinvest the income generated by your investments to accelerate growth.

Automate your savings : Set up automatic transfers to avoid procrastination.

Remember: Financial growth is not a sprint, it's a marathon. Consistency and discipline are keys to success.

One of the most inspiring stories involving compound interest is that of Warren Buffett, considered one of the richest men in the world.

He started investing at age 11 and has since used the principles of compound interest to build his fortune. Today, at 90, most of his wealth was accumulated after age 50—living proof of the power of this strategy.

Another example comes from Sweden, where a man named Ingvar Kamprad, founder of IKEA, taught his family to save from an early age. His philosophy was clear: "Small savings, made regularly, result in large fortunes." And he was right!

These stories show that no matter where you are today, it's never too late to start. What matters is taking the first step.

Compound interest is more than a mathematical concept—it represents a transformative opportunity for anyone interested in building a solid financial life. Starting early, choosing good investments, and maintaining discipline are fundamental pillars for making the most of this mechanism.

So, what's your next move? Will you keep putting it off, or will you decide today to harness the power of compound interest to your financial independence? Leave a comment below telling us what you thought of this article or share your own investing experiences. Remember: your decision today will shape your future tomorrow.